The Risk Matrix, a key tool for the company

Today, companies, beyond its size and its commitment to the Compliance function, must comply with a series of fundamental steps. The design of a business-specific risk matrix allows companies to plan and design remediation measures in the event that any of these become a potential real event.

An accurate determination of their own risks in an organization is a key and fundamental process when developing an integrity program. The map or risk matrix allows them to determine the actual needs of an organization by allowing the proper and limited use of the company’s available resources.

The use of risk matrices goes back several decades ago and it was basically related to the areas of corporate security or loss prevention. Its development and management allow a company to know precisely what risks and threats it faced, also the vulnerabilities it has and the possible consequences that the occurrence and impact of such threats could have.

The design and preparation of a risk matrix is not complicated, but very detailed. Usually, the process involves different steps that the Compliance Officer must follow precisely.

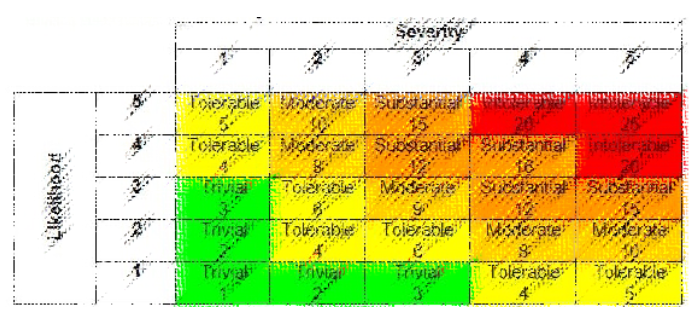

The process consists of two key parts:

a) – Mapping of all possible risks by areas or sectors, and

b) – Extrapolation of these to a decision’s matrix (probability vs. Impact).

From the result that the matrix shows for each of the risks identified, which can normally range from avoid, mitigate or transfer, the Compliance Department, must assign a responsible for each risk-area (Risk Owners) for the development of appropriate control measures and work together to integrate everything into a joint solution.

We must understand that the management of a risk matrix is something dynamic and that it must be updated on a regular, perhaps annual or 6-monthly basis depending on the complexity and dynamics of the company. We must avoid the mistake of considering that this is something that takes place only once and then set aside, on the contrary, it is something “alive” that needs constant attention from those who do Compliance in an organization.

Another aspect that is good to consider is that the risk matrix can be designed with a higher or lower level of complexity, both in its probability and impact index variants. The higher the level of detail, the greater the accuracy in individual risk decision-making. At a lower level of detail, risks can be handled in a group or joint way depending on its rating.

Other way to visualize the results obtained in the matrix, is to show them into a dispersion chart, which gives us a broader picture of the risks in the organization, how they are grouped by type, what are the areas to pay more attention, which of them represent complex threats, etc.

Whatever the matrix model to be used (more complex or less complex) or what additional tools we can handle, what is clear is that we must use it in Compliance management.

In G5 Integritas we have highly trained professionals who can assist you in designing the best Integrity Plans. If you are interested in optimizing the security of your company, we invite you to contact us at: info@g5integritaslatam.com Or visiting our website at: www.g5integritaslatam.com

0 Comments